Quant High-Algo Advantage Market Overview

- The High-Algo program is a portfolio composed only by the most liquid futures markets such as Mini S&P 500, Mini Nasdaq, Mini Dow, Mini Russell, Crude Light, Natural Gas, Gold and by using different uncorrelated markets, we achieve a diversification that usually results in less risk and a better overall performance.

- In order to further increase the diversification, High-Algo can have more than one system on each market. For example, the program could have a day trading system on Nasdaq that works on a 15-minute time frame with a counter trend logic and a swing system, on the same market, that works with a 30-minute time period with a long only breakout logic.

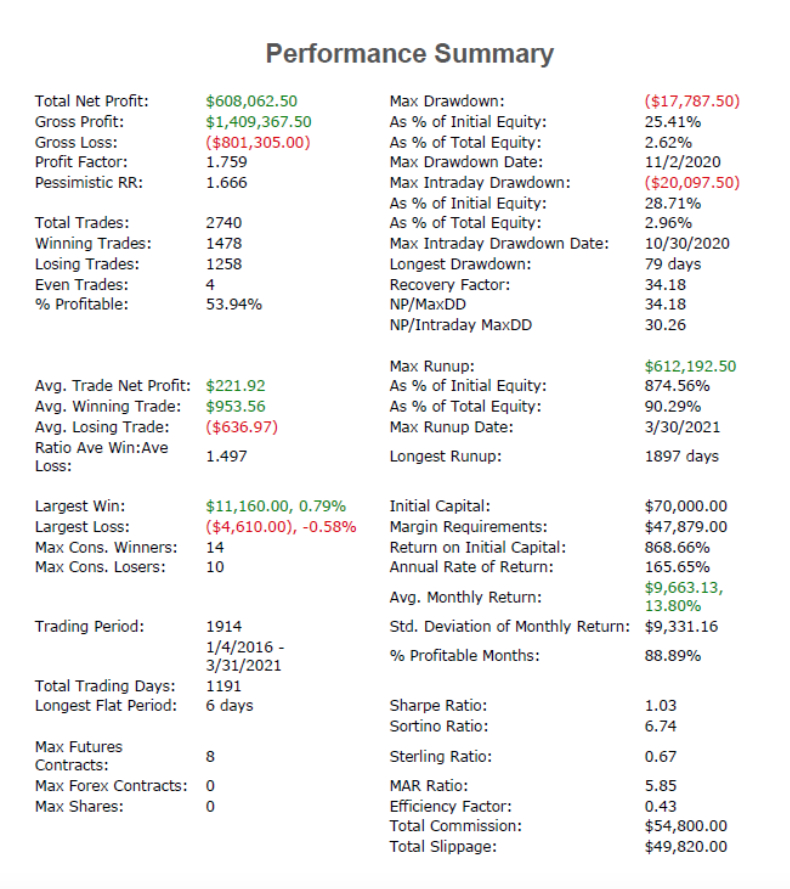

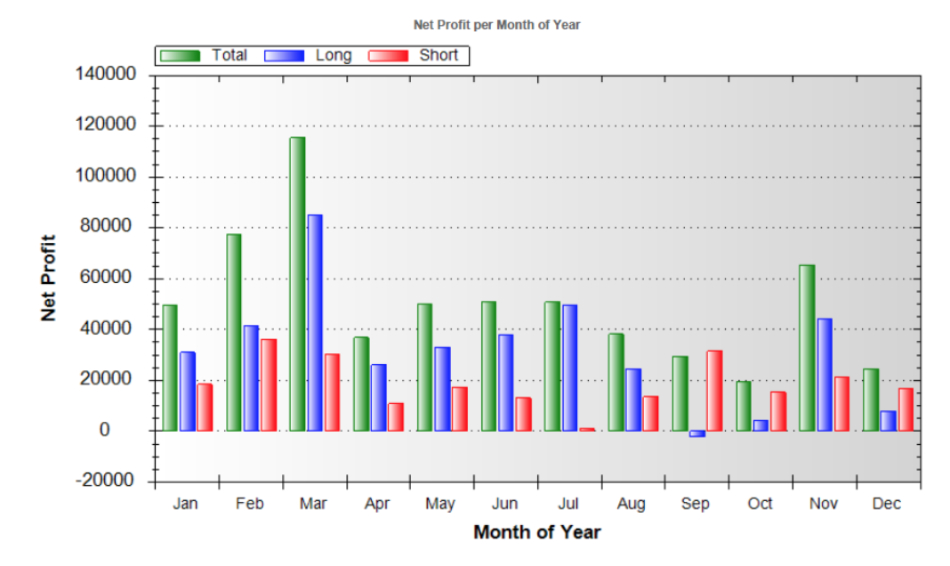

- The goal of the High-Algo portfolio is to obtain positive results that are not correlated with traditional investments and the general performance of the stock market. By mixing uncorrelated markets, multiple systems logic and by dynamically adapting the composition of the portfolio to the current market conditions, the system is able to produce a smooth equity curve, with great results and acceptable losses and drawdowns.

- Minimum Account size is $60,000 – $70,000

- Average monthly trades = 40

Click image to open larger view